The need for active management has never been more valuable than in the current economic climate.

Active portfolio management is as much about protecting the downside, as it is about maximising the upside. In the Fixed Income or Global Credit space, one of, if not the biggest, downside risks is the risk the underlying issuer of the bond defaults in making payment to the holder of the bond, eg. the Fund Manager. That is, Credit Risk.

This is where Credit Default Swaps (CDS) play an integral role in mitigating the risk and protecting the downside.

To protect against Credit Risk, the active Fund Manager can purchase a CDS and effectively transfer or swap the Credit Risk to the issuer of the CDS, in same manner as a home insurance policy works. Should the house burn down, the insurer assumes the risk and financial downside.

In the bond market, should the bond issuer default in making a payment to the bond owner, the issuer of the CDS ensures the Fund Manager doesn’t suffer a loss.

When financial conditions are stable and the issuer’s Credit Risk is considered low, the cost of a CDS is also low. Conversely, when conditions are potentially more challenging, the price of a CDS rises. The cost of the CDS is referred to as the spread and quoted in basis points (0.01%).

Apart from acting as an insurance policy for the Fund Manager, the movement in the cost of a CDS also gives you an insight into prevailing market conditions. The past few months reveals a great example of that.

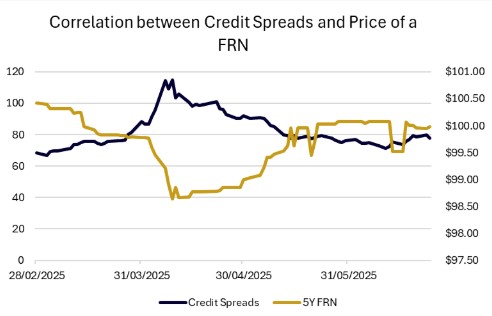

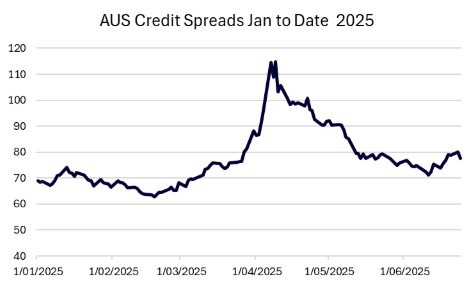

The graph below illustrates the movement in the CDS spreads over the past 6 months and highlights correlation between the spreads and the bond market’s uncertainty over that time.

As the fallout of Trump’s Tarriff war escalated during March and April, so too did the fear of bond issuer default, which saw bond yields rise, and bond prices fall. To offset the falling bond prices and portfolio value, the CDS increased in the value.

Had there been an actual default, the CDS would have been settled with its issuer to offset the physical loss of the default.

Some Fund Managers participate in the issuance of CDS as means of generating premium income and additional return for their portfolio.

However, the risks of doing so are significant, as evident in the GFC when the issuers of the CDS were hit with a large number of defaults and they couldn’t settle on their CDS obligations.

AL Capital Global Credit Fund prides itself on active management and also on risk management. While CDS are used as a tool to manage credit risk, the Fund does not participate in the practice of issuing CDS to generate additional income, due to the risks involved.

The Fund’s key characteristics are;

- Low risk profile

- Has delivered consistent monthly returns since inception

- Offers daily liquidity

- Invests in Investment Grade bonds

- Is fully currency hedged

- Relatively short interest rate and credit risk duration

- Experienced management team

- Quarterly distributions

![]()

Phil Smith | AL Capital

Head of Distribution | Director

For more details and to explore how you can invest with AL Capital, please contact our dedicated client relationship team today.

LEARN MORE ABOUT AL CAPITAL